Fall season paints a picturesque scene of multi-color foliage with leaves strewn around like confetti and nature gracing us with cooler temperatures.

It can also be a harrowing time for parents and college-bound juniors/seniors as they scramble with their college applications, final SAT/ACT scores a while they await with bated breath on that number that a FAFSA lists as the annual cost of attending the college of their choice. And this number is unique for each family!

This might be the parent’s second major investment after their home. Through the college journey, parents dream of their children discovering their passions, gaining tools to navigate life’s challenges and ultimately finding happiness and success in the paths they choose to pursue. However, parents often experience profound anxiety when grappling with the daunting costs associated with financing their children’s college education.

Not surprisingly, their household net-worth plays a big role in arriving at the financial aid for their child’s respective college. The overall cost of college can either break the bank or put the household at risk of high indebtedness without prior planning.

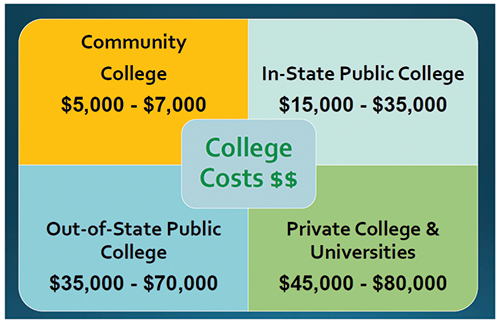

Let’s look at the annual costs of college in 2023 depending on the type of college and program:

Every family’s contribution towards their child’s education varies based on family income/assets and their chosen college’s cost of attendance. This is most effectively derived through the annual FAFSA (Free Application for Federal Student Aid) Application. This year, the FAFSA is undergoing significant changes and will only be available in Dec as opposed to Oct 1st.

The FAFSA is completed for each year of enrollment at the child’s college, so income/asset planning can go a long way in making the Family’s Contribution more manageable. The EFC is rebranded as Student Aid Index (SAI) and what’s left after Family’s contribution towards the Cost of Attendance is classified as Financial Aid. This is disbursed out in way of loans, work-study programs if eligible or scholarships if eligible.

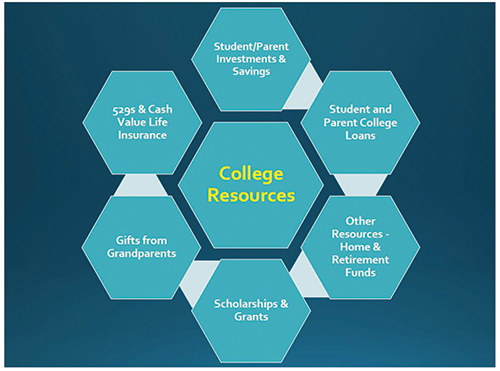

The various sources of funding available to students:

• Grants – State, School, Local municipalities, Special Interest Groups. Grants are typically need based and are based on the child’s Student Aid Index.

• Scholarships – Offered by college or an Employer or a caused-based organization. They typically reward academic achievement or sporting/extra-curricular abilities.

• Loans – Students and parents are eligible to borrow via Federal Loans. Students have access to subsidized (where interest accrued through school is paid by Dept of Ed) and unsubsidized loans (where the accrued interest is added to final loan balance post-graduation). Parents are also eligible to apply for PLUS (Parent Loans for Undergraduate Students) through the Federal Direct Loans program towards financing their child’s college. The Federal Loans are capped and carry a fixed interest rate and don’t involve underwriting, thus making it more accessible for students to finance their undergraduate degree when they may not be gainfully employed. In addition, parents can also borrow from private institutions such as So-Fi.

• Work-Study – whereby students have access to campus related work-opportunities to offset tuition costs while in school.

Grants and Scholarships don’t have to be repaid, but loans do. This is an important distinction.

Other Financial options available to Families:

• Savings Accounts or CDs

• UTMA, UGMA accounts – These are custodial accounts, funded by parents and owned by children once they’re of age and can be applied towards college expenses.

• 529 Plans – College Savings accounts, administered by the state and offer tax-free distribution towards qualified college expenses.

• 529 opened by other family members listing your child as a beneficiary.

• Cash Value Life Insurance.

• US Savings Bonds – mainly Series EE/Series I Bonds where interest earned is tax-exempt if paid towards college expenses.

• Leveraging Real Estate Equity through a Home Equity Line of Credit.

• Penalty free distributions from Traditional or ROTH IRA or Retirement accounts (401K).

Other ways to reduce cost of college:

1. Community College – A 2 year’s Associates degree offers transferable credits towards an eligible in-state college thereby reducing cost of attendance overall.

2. Currently only 40 percent of the students graduate in four years. Graduating on-time avoids an additional year of tuition and overall cost of attendance.

3. Avoiding switching majors between the years. Often, scholarships/grants are contingent on course and college selection and switching majors/colleges can increase overall cost of attendance for future years.

While parents look for ways to fund their child’s college dreams, they also need to keep an eye on their own retirement needs for the following reasons:

1. Financial Security: Retirement years can span decades and relies primarily on retirement savings, Social Security, and possibly pensions. Without adequate retirement savings, one risks experiencing financial hardship and a reduced standard of living, potentially becoming a burden to your children.

2. Time Horizon: Retirement savings benefit significantly from compounding interest. Delaying retirement savings can result in the need to save much larger sums later, which may be financially unfeasible.

3. Healthcare Costs: Aging causes healthcare expenses to become a significant portion of one’s retirement budget. Having ample retirement savings can help cover these costs without straining finances.

Parents, while it’s natural parental instincts to want to support your child’s education, we’ve seen above they have many options at their disposal. In contrast, there are limited sources of income for your retirement beyond what you save, making it a more critical financial priority. In short, balancing your child’s college aspirations without straining your own retirement needs is not just a seasonal task, but an on-going open family conversation.

Rupa Pereira is the owner and lead financial advisor at FWJ Planning, an investment advisory and planning firm registered in NC. As an enrolled agent, she’s also authorized by IRS to represent her clients on tax-matters. Contact: [email protected].