I escaped the post-election frenzy in the US by taking a short trip to visit my parents in Mumbai, punctuated with an exploration of Kerala backwaters and Kanyakumari. It was refreshing to get away from an incessant news cycle that foretold doom and gloom for the future.

However, as I started to look forward to 2025, I realized that on the tax-front, doom and gloom could very well be a likely scenario. Here’s why.

The Tax Cuts and Jobs Act (TCJA) was a major overhaul of the tax code, signed into law by President Donald Trump on January 1, 2018. It was the largest tax overhaul that I’ve witnessed in the last three decades. TCJA is set to expire on December 31, 2025, unless Congress acts to extend it. Why is such a big deal and why does it matter?

For starters, here are some key provisions of the act:

• Higher Standard Deductions

• Lower Tax brackets

• Higher Child Tax Credit

• High Estate Tax Exemption Limits

• No Health care mandate – (no federal penalty for not carrying health insurance)

• Corporate Tax Rate set at 21% vs previous tax rate of 37%

• Qualified Business Income Deduction for passthrough business entities such as LLCS, partnerships and S-Corps and Sole-proprietorship

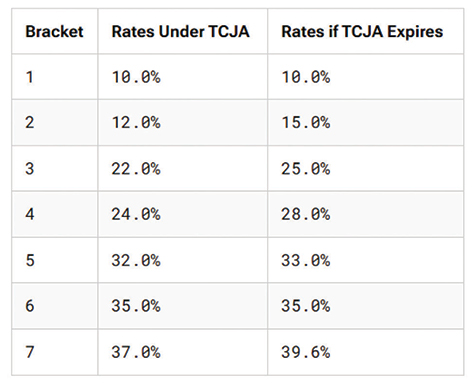

While most of the above may affect us on the periphery, the one that would bite 2-income family households would be tax brackets. Here’s an example for families currently in the 22% or 32% tax bracket in the most recent tax year.

Comparing Current TCJA (2023 Tax Year) vs. Pre-TCJA Rates

With income thresholds remaining identical between the pre and post levels at a respective bracket, as we see above, families will be hit with higher federal taxes at higher income levels affecting their take-home paycheck.

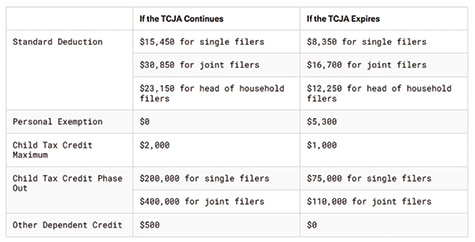

In addition, based on calculations from Congressional Budget Office (CBO), here’s how various family related provisions would be affected if TCJA expires. Note the values are inflation adjusted.

A Key Takeaway. Without TCJA, middle and higher-income families would face:

Decreased disposable income, as federal taxes claim a larger share of earnings. These changes could have a notable impact on family budgets unless offsets (like deductions or credits) are adjusted. This is something families are not prepared for since most tax withholdings happen through paychecks and it’s not directly visible until they see a lower direct deposit.

Positives of TCJA expiring

On the bright side, there are a few provisions that were suspended under TCJA:

The suspension of the 2% miscellaneous deduction has especially impacted employees with significant job-related expenses or those paying substantial fees for investment and tax planning.

Under TCJA, W-2 employees were no longer allowed to deduct job-related expenses that the company didn’t reimburse. If TCJA expires, that provision will return, which could benefit millions of Americans who work some portion of their work week at home, including mileage, home office supplies, union dues, uniforms, internet, telephone, magazine subscriptions and meals.

The TCJA suspended all miscellaneous itemized deductions subject to the 2% floor through 2025. This means that taxpayers are no longer able to deduct any of these expenses, regardless of amount or AGI, for tax years 2018–2025.

Investment, tax planning, professional membership and licensing fees could be deducted subject to the 2% rule, post TCJA.

State and Local Tax (SALT) deduction limit of $10K –impacting those with higher property taxes and state income taxes from deducting the entire amount in their Itemized Deduction.

Conclusion

However, since the electorate has re-elected the President that signed this into law in 2018 and with control of Congress, there’s optimism that the sunset may not occur. Extending all the provisions will increase debt levels and the deficits, which are already at high levels relative to tax revenue. So, they will have to prioritize what stays and what expires.

While we usher in a new year, we have to brace for the possibility that certain tax provisions we’ve gotten used to may sunset by the end of the year. Maybe, then I might be ready for another trip to India and soak in serene backwaters while Congress works through the wire to restore TCJA. Time will tell if we’ll witness another never-ending saga on tax topics through the year.

Rupa Pereira is a CFP, EA, CSLP and an Advice-Only planner and tax professional specializing in cross-border planning and education planning.

Contact: [email protected].