Estate planning aspect always raises much discussion, starting with “What exactly do I need to do at this stage in my life.” Or some variation of that thought. Most of these questions pop in the head mostly because people really have not thought much about it. They have not thought about what will happen to their estate at the end of their life or even worse, what will happen if the demise happens suddenly with nobody else knowing what to do since there were no instructions given or available and no discussions had happened amongst affected adults.

The most common practice in Asian countries was, as far as I can tell, to distribute all the property while the senior person or couple is alive and then expect that the next generation will take care of them for the remaining years of their life. It is probably worthwhile asking the question: will it work today, even in Asia? I will leave the answer to you.

My article a few months ago about “Creating the end-of-life estate planning” generated much interest from younger families as to what should be done by them, if anything. The simplest answer is much can be done and that they need to follow the same thinking and ideas as expressed in that article but that by itself will not be enough for them. What do I mean by that? For younger families, the burden is not only to take care of a young partner who has a much longer life to deal with but there are much younger children involved who must be taken care of, financially for sure, amongst many other issues like their own proper development to adulthood.

My article a few months ago about “Creating the end-of-life estate planning” generated much interest from younger families as to what should be done by them, if anything. The simplest answer is much can be done and that they need to follow the same thinking and ideas as expressed in that article but that by itself will not be enough for them. What do I mean by that? For younger families, the burden is not only to take care of a young partner who has a much longer life to deal with but there are much younger children involved who must be taken care of, financially for sure, amongst many other issues like their own proper development to adulthood.

Just imagine a young family, parents in their mid-thirties or early forties and their children ranging from single digit age to teens and one parent has a sad demise. Usually it is a sudden illness, car accident or an unexpected calamity. When this is mentioned to them the first reaction is usually that “it will not happen to us.” Not sure what makes them to think that way but that is the way the mindset usually is, such as bad things only happen to others.

So. what needs to be done?

I will talk more about financial aspect of the question and stay away from the emotional toll that all such sudden bad events take, though that is also an important consideration. If both parents are working, then at least half the income is still there but the expenses keep piling up. Life takes an abrupt turn while the other partner is required to step in to carry full load for quite a while. It helps if outside help is available from relatives and friends.

So let me go into some solid steps that need to be taken now by young families so that this sudden burden can be eased and stresses are assuaged.

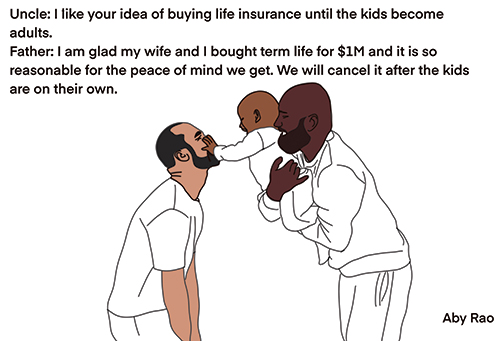

1. Both partners together must have enough term life insurance to support the family and the young ones to get them to go on their own (generally through college). I would suggest not less than $1M per person. Assuming good health, the premium is not more than $35-40 per month/per person. Do not bank on the insurance from the place where you work since additional insurance there is expensive and then it disappears when you change jobs.

2. A trustee must be in place to take care of many financial and other aspects of a sudden demise in the family. This person can be anyone, friend or a relative, whom you implicitly trust. It is a good idea to have more than one name ready, available, and mentioned in the Will since “trustees” have a right to refuse to take on the responsibility for whatever reasons they may have.

3. A guardian for the children is a must and chosen carefully. For the same reason mentioned above, you should have more than just one person available. It is best if this person/family has the same philosophy as yours to raise children and carry on with the family affairs. For this reason alone, amongst others, there is a strong need to discuss all these detailed matters with the future guardians so that nothing is left to chances.

4. A Will package in place to support all the above-mentioned issues and more. This is a package of four documents, Will is one of them, and I suggest strongly that everyone should have this ready and available all the time. If anything, this is probably the most ignored item, but it happens to be the most important. Almost 50 percent of the US population does not have a Will. That is sad. It is an important and critical document and really does not cost much money.

5. Both partners/parents must be completely conversant and aware of their own financial situation. This will allow them to not only to carry on in the absence of one partner, but it will take each partner out of a total blank slate situation where the partner has absolutely no idea what is going on to make any hard decisions.

6. While the children are young, these documents and ideas (like the guardians) should be revisited every few years. Circumstances change, our ideas change, we move to another place and many other things can happen which will prompt to revisit the documents and make sure that we still have our latest wishes expressed in there.

7. Recognize that life is fickle, fragile, and tends to be fastidious.

Mo Vidwans is an independent, board certified financial planner. For details visit, VidwansFinancial.com, call 734-476-0579 or write to: mvfinancial@yahoo.com