In the world of Stock Market investing, covered call strategy is a neat way to generate some extra income, and we will discuss the basics of that here. It assumes that you own and handle your own account and is not operated by some agent. You have been buying and selling (even though I would assume it would be mainly buying) your own securities as and when you decide.

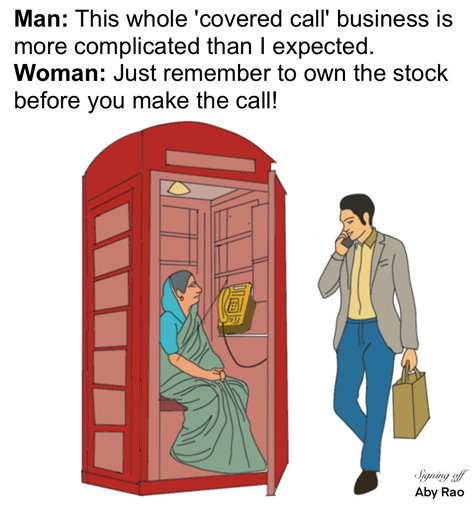

Let me explain what a “call†is first and then we will consider a covered call strategy as the title of this article suggests (there is also a naked call strategy which we will not consider here for the primary reason that it is a risky proposition). It is called covered because you already own it.

Call is a way to put your stock on the market and make some money even if you do not sell it. Let us consider this: In your account that you operate yourself, you already own a stock, and you think the stock price may not be moving as briskly as you would like. There could be many reasons you would wish to sell a stock, but I just took this as an example.

So, you tell the market (exchange) that you wish to sell this stock at a certain price (higher than today’s price) say three months from now (or could be six months, nine months or even one month from now). These are all standardized practices and your broker/dealer will be more than happy to help you with all that, especially when you are just starting to put your covered call(s) on the market.

Someone on the open market buys your call contract and pays you some money for buying the contract. Now if the price does not reach your expected price, the one who bought your covered call contract will not go through the deal and you can pocket the call contract money he paid you in advance. This is the extra income. If all the circumstances line-up and the buyer of the contract wants to buy it, then he must also come up with the full price for the number of shares he is buying.

Someone on the open market buys your call contract and pays you some money for buying the contract. Now if the price does not reach your expected price, the one who bought your covered call contract will not go through the deal and you can pocket the call contract money he paid you in advance. This is the extra income. If all the circumstances line-up and the buyer of the contract wants to buy it, then he must also come up with the full price for the number of shares he is buying.

Now let us put some terminology behind these deals so that we get conversant with it. A covered call strategy involves writing an “I wish to sell†call intentions against the shares you already own.

The price you choose to sell the shares is called “strike price.†You write the call option contract (one contract is 100 shares) to sell one contract say three months from now at a strike price.

The buyer of your contract will pay you some money now (called option premium) to buy your contract; this money is your extra income.

When the time comes, three months from now, if the stock reaches or exceeds the strike price, you will have to forgo the shares that you put out at the strike price. The buyer of the contract will pay you the strike price for all the shares. This is the basic concept. Most of it is well-mechanized.

You must decide which stock and how many shares, the contract price and period and the strike price, and see if someone bites into your offer. The longer the period, the higher the strike price and contract price.

You have a way to get out of the contract by buying back the contract at a price. The option premium is a function of the current stock price, the strike price, interest rates, time to expiration and the stock’s implied or expected future and volatility. Premiums tend to be greater in more volatile markets and increase the attractiveness of the covered call strategy.

The writer already owns the stock

Writing a call option without owning the stock (this is the naked call) exposes the option writer to potentially unlimited risk because if the option were to be exercised, the writer, not owning the stock outright, would have to purchase the stock in the open market, conceivably at a ruinous price, to deliver it to the owner of the option. However, the covered call option is not risky since the writer already owns the stock prior to writing the option.

Now you can probably comprehend how and where the names of covered and naked options come from. Clever and appropriate.

Let us take an example. Imagine we are still back in October of 2022, and you own 300 shares of Microsoft (MSFT). You do not expect the share price to appreciate much over the next three to six months; so, you decide to employ a covered call strategy.

Let us say the price then was about $242 per share. Since one option contract involves the purchase of 100 shares, you write or sell one contract with a strike price of $250 and expiration of Jan 20, 2023. You receive a premium of $10 for each share in the contract.

At the expiration of the contract time, if the stock price exceeds $250 you will have to deliver / surrender 100 shares. In exchange you will receive $250 for each share of MSFT.

You have already received $10 per share so it makes a total of $260 per share plus any dividends if they were declared within the period. Your profit is $18 ($260-$242) per share over the two-month period, which is substantial.

As it happened, the Microsoft shares closed at $240 on Jan 20, 2023. Because the option expired “out of money,†which means useless, you keep your shares and $10 premium that was already paid (and the dividends).

It is still a good return, and you are ready to play this call again.

The covered call strategy allows an investor to benefit from price appreciation up to the strike price. The premium earned by writing an option depends in part on the strike price and the time to expiration. The lower the strike price the greater the premium since it is more likely that the stock price will exceed the strike price and the option will be exercised and the option-writer has to be ready for it. When the prices drop again, the stock can be bought back if there is still interest in it.

Farewell

Now I must bring your attention to another important piece of news. I will be retiring, and this will be my last article for Saathee magazine. For over 9 years now, under the stewardship of the Editor Samir Shukla, I have been writing these Financial Planning articles for the readership of this magazine.

It was my privilege and a pleasure to be able to serve you. My primary thought always was that everyone should have reasonable knowledge about estate and financial planning to make some meaningful and pertinent decisions in their family affairs and I sincerely hope that they were useful.

I also wish to extend my sincere thanks and appreciation for the artist, Aby Rao, who was very resourceful and punctual in creating the art. My best wishes to you all. Thank you.

The Saathee Staff offer special thanks to Mo Vidwans who has written the Personal Finances column for nearly a decade and the December 2024 issue marks his last. We wish him well in retirement.

Mo Vidwans is an independent, board certified financial planner. For details visit, vidwansfinancial.com, call 734-476-0579 or write to: mvfinancial@yahoo.com