NOTE: Our March 2020 issue republished the February 2020 article in error. This is the correct article for the month.

We see our retirement accounts (401k, IRAs) grow and it delights us. Sometimes they grow even faster than our regular savings, primarily because of a variety of reasons like company contributions, well placed investments and others. It is a source of pleasure and always good to know what we can bank on these for our retirements.

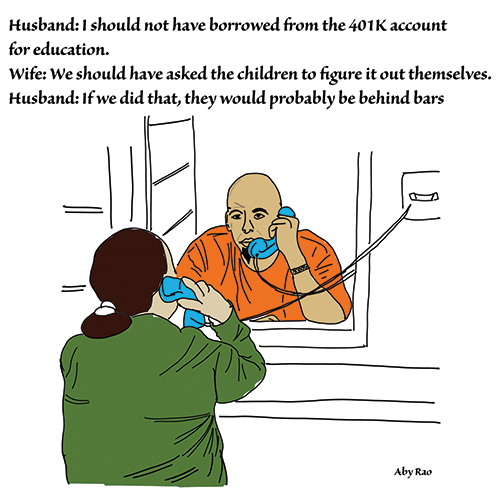

Therein lays the dilemma: these accounts are meant for one purpose and only one purpose, which is supporting our retirement. But the temptations are always there. Such a large cache is sitting there and all of a sudden we see a need coming up (like sudden illness, wedding, car purchase, special occasions, even college education) and we are thinking maybe we can tap into that account temporarily to satisfy the need. At first blush, taking out a “Plan loan” can sound like easy tax-free money. The thinking in the back of our heads is there is plenty of time to pay it back and make up the deficit after borrowing. Think again.

Let us first explore under what circumstances it is even possible to borrow from such accounts (plans). The rules are tricky and violations can trigger costly taxes and penalties. We need to understand Plan loan rules. These are precisely the rules we generally don’t pay much attention to since we had always resolved that we were never going to touch it and borrow from these funds when we started the contributions to the program.

The advantages to tap into such plans can be initially seductive. For one thing they are just sitting there with easy access. Loans are generally easier to obtain than other bank financing. Poor credit does not factor into approval process. They are initially tax-free and penalty-free and can continue to be so if all the conditions are met. They certainly have lower interest rates than loans available elsewhere like on the open market. They require repayment back to the original account and not to a bank. Optional loan provisions can always be adopted.

But stop. There are conditions that must be met for this preferential tax treatment. For sure, every 401k or IRA plan has its own rules and the plan conditions must be met. Loans are limited to a maximum amount decided by how much you have saved in your plan. Tax code permits or limits plan loans to the lesser of 50 percent of the vested account or $50,000 max. The repayment period must fall within the statutory period and repayment must be made on at least a quarterly basis. And of course interest will be assessed on the repayments.

A loan against a 401k (or IRA for that matter) may seem particularly attractive but it can cause tax problems if not handled precisely; tax problems come into play when the repayment rules are not carefully followed.

There are many court cases that can be reviewed. But the gist of most of them is the same. Money is borrowed from the Plan accounts, then the person leaves the job or something else happens and the loan goes into default which forces the plan to treat the balance of the loan as withdrawal and not borrowed money and hence taxes and penalty become due immediately. A 1099R gets issued at the end of the year and it becomes very unpleasant from that point on.

Anyone thinking of borrowing from the plan should be well aware of the fact that it should be done only as a last resort and it should not be the first thing that comes to mind. To be sure there are many other alternatives available, may be not as attractive as borrowing from the Plan (but certainly not as devastating either) and they all need to be considered first. Also keep in mind that the retirement money not only should be cherished and protected properly, but should never be touched for such purposes. Even if you are able to follow the plan and repay back every penny with interest, you are certainly impeding the growth of that account for that period and that effect can compound over time.

Three points to be taken away from this:

Plan loans should be the absolute last resort, if at all. I don’t know anyone who will advance you a loan for your retirement but for the purpose you may be borrowing from the Plan there may be many willing to lend.

Always check the details of the 401k or IRA plan. This is some thing we hardly ever do at our own detriment and then we get surprised when it is pointed out by the officials. If the language is not something that is easy to understand then you need to get help from the company officials who should spend time with you until it is clear. It is really in the interest of both parties. Do not rely on the general inferences made by the HR person or plan representative. Such statements do not hold up in court in the face of the statements made in the official plan communication and that you may have signed.

Plans that are created by IRS, under the jurisdiction of the Law passed by Congress, can be rather rigid with not much room for negotiations whereas borrowed money at other places there could be.

There is no substitution for proper long-term planning which would consider all future events that are important to you and your family and create a spike of cash for those events. The best planning is when the need for borrowing does not come at all. Can we ever get there?

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.