At the urging of a Certified Financial Planner, you have done all the Estate Planning documents; you have your wills and Power of Attorneys. You feel good and proud that everything is in place now for all contingencies. Think about it, though, is it really?

I have witnessed a few times the painful results of what can happen when, in spite of all the meticulous preparation, someone hasn’t prepared for the end of their life. Don’t get me wrong; all that preparation that you just went through is necessary and a welcome sign that you have looked at all the financial details and other possible scenarios but this last detail could turn out to be the most significant one.

I had a phone call about 7 or 8 years ago from two brothers, in their early 50s; I didn’t know them personally but I had done much planning work for their aging parents. Their complaint was, essentially, that they wanted to sit down with their parents and talk about the parents’ financial situation; they knew they were the trustees for them and they will have to carry out all the responsibilities as thrust upon them by the parents in their will and other documents. It was commendable that they wanted to know ahead of time what the parents’ desires were and how they wished to carry them out. If much of this homework is not done ahead of time, it could cause confusion, and worse, disagreements among family members about everything from business and medical care decisions, funeral plans to eventual splitting of the estate. What could have been a time of sharing meaningful memories could have turned into unresolved administrative details. Consequently, the process of winding up the estate takes much longer and could consume time and energy.

The simplest way to think about this is that after death, the deceased person is not there to explain any of his/her thoughts if it is not amply made clear ahead of time. One of greatest legacies you can leave your loved ones is to ensure they have the information they need if you are unable to speak for yourself due to illness, injury or death. This kind of preparation allows your family to support your recovery, grief and celebrating your life, rather than being consumed by stressful searches for proper information or resolution to family conflicts in regard to decisions.

What needs to be done?

That is the obvious question that will pop up in anybody’s mind. It turns out that there will be a lot that needs to be done. Many people simply avoid talking about this early enough. They initially did not wish to divulge any such information and that came at a great cost.

Basically, we need to start talking. We need to take our trustees, and actually many other people depending on the circumstances, fully into our confidence, sit down with them for serious conversation and explain to them what is in the will and other documents (in fact give them a copy to read and digest) and talk about what concerns, or questions they may have. Let me tell you this is much easier to say than actually carry out but it needs to be done. Think about it this way. After death, they are going to find out any way, if they are the trustees, but at that time they are scratching their heads if something is not clear to them and the right person is not around to explain. If all of this is discussed in advance and the trustees know exactly what the deceased person intended, wouldn’t that be wonderful?

The other aspect that consumes the most time for the trustees is finding out the financial accounts’ information. Where documents are located, what banking and investing institutions, account numbers, IDs and passwords, contacts and phone numbers. It almost behooves you to put all this information together in one place and let the trustees review it. That would be such a blessing for the trustees if they know all this ahead of time and have appropriately discussed with the grantor.

If there is distribution of physical property, like special china, heirlooms, furniture, curios, vacation property and similar items, it becomes even more complicated and quarrelsome if the division is not discussed ahead of time.

So why don’t we do this?

In at least 95 percent of cases, if not higher, these types of actions are not taken and I have to wonder why. The benefits are very obvious; even though I have to admit that the benefits all go to the trustees and there are no particular benefits to the grantor other than eternal feeling that everyone is happy with their inheritance; that in itself has to be a great source of satisfaction.

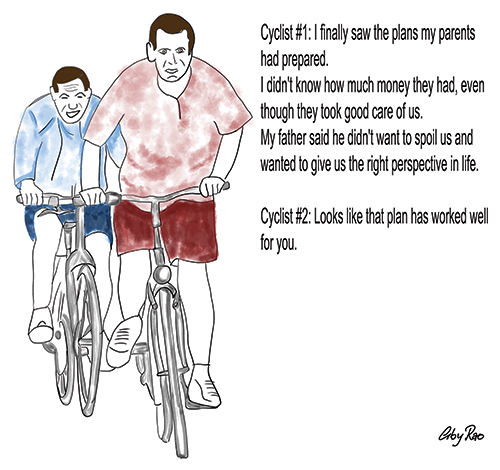

Human beings are complex and private people and human nature is complicated. Personal and financial matters are always closest to everyone’s hearts and we have a tendency not to disclose any of that to anyone unless it is absolutely necessary. Especially in financial matters, we seem to have a fear, almost a phobia that others will regard us differently once they know what our situation is. There is also an element of embarrassment and some emotional challenge in disclosing private information to even the closest one to you who, normally, would be your trustee. There is also a thought in the back of our heads that we want to maintain our existing parent/child relationship like it was when the children were little and the reversal should be delayed as much as possible. But, unfortunately, as much as we don’t wish to, we have to face the fact that the reversal is inevitable. Why not then make it easy for everyone concerned?

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.