With so many new laws enacted just since 2017 when the TCJA passed (the latest was CARES about the insurance adjustment due to Corona virus) we had much more to think about our own financial situations, which can be affected by these laws and indeed they have. Especially the TCJA of 2017 which affected how we were doing the tax returns and then the SECURE act which forced us to throw our thoughtfully made retirement plans out the window.

Many people had diligently saved for years, if not decades, in their retirement accounts. They had carefully structured estate plans with hopes that years of savings and hard work would not only support their own retirement but also help provide a legacy for their children and perhaps even grandchildren. And then Congress pulled the rug from under their feet.

So, the obvious question I am pondering is if it is possible to plan and do things that will minimize the impact of such sudden actions by the Congress. Or at least take more control and keep things as private as possible.

One thing I notice many times is that while doing great financial planning work (worrying about IRAs, 529 plans and tax planning etc.) we don’t pay much attention to avoiding probate upon a person’s death. If you have a will-based estate plan or do not have one yet then it is possible that some or all of your estate may get exposed to probate – a court process where a judge comes in the picture and tells the executor and family members what to do and settle the final financial affairs. It’s a process which adds totally unnecessary delays, costs, headaches for sure and slows down all progress. It is no wonder that people want to avoid probate.

Adult guardianship (also known as living probate) is another scenario where we have to be careful how to draft our documents; in essence we should be all ready for it if the need arises. If someone becomes mentally incompetent due to a variety of reasons like Alzheimer’s, dementia, stroke, sudden accident, or a prolonged illness, then someone must be there (with proper power of attorney) to take over and make decisions for that disabled person. A constant thought in the back of our heads is “oh, that will not happen to me,” but just be cognizant of the fact that everyone else is thinking the same way and these things do keep happening to people. Many times, just a durable POA is not sufficient and consideration must be given to creating living trusts.

At the moment the limit on when the estate taxes apply is high (over $11 million per person) and over 99 percent of us don’t get affected by it. But that is today; just a few years ago that same limit was just over $5 million. By today’s law, the $11 million limit is supposed to revert back to over $5 million at the end of 2025. New elected officials and changes in governments due to elections can alter these situations. We look at our today’s total estate and decide in our own minds that we really don’t have to worry about estate taxes even then. Most of the time we forget the high insurance value we may have or an inheritance that we were not expecting which might push us over the $5 million limit. It might be wise to know that not too long ago that estate tax limit was under $1 million.

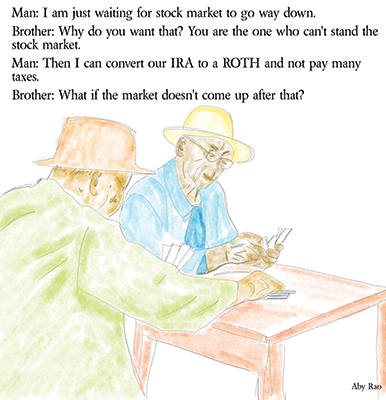

I have written exclusively about SECURE act just a few months ago which made sweeping changes to the retirement planning rules that we were all banking on. Courtesy of TCJA act of 2017 we are also experiencing some of the lowest tax rates of recent times. Even though it may not go up for all layers of income, they could go up for those in the upper incomes, who are more likely to be affected by the changes in the tax rates. These possibilities have created enough anxiety in many minds to reconsider their investment strategies. Most common one is if and when to convert retirement accounts to ROTH IRA at today’s low-income tax rates. That will also depend on the income tax rates of the inheritors of your accounts when the time comes.

It is also very possible to convert the account into a regular account by paying taxes now and then invest in individual stocks when the step-up in basis comes in the picture and the inheritors pay none to very little taxes. To be willing to invest in stocks your own risk tolerance has to be accounted, too. As you can see, there are many facets to this equation that need to be addressed simultaneously.

Life insurance planning is a strategy that is quite popular and is being used by many to pass on estate to the next generation rather successfully. The reason for it is that, if structured properly, life insurance has enormous income tax benefit under the tax code. A permanent life insurance policy can function much like a ROTH IRA with the ability to withdraw money from the policy tax free. A permanent life insurance policy is also more flexible in many other ways. Needless to say, these rules are also subject to the whims of Congress but the same rules have been around a long time and are heavily bolstered by a strong lobbying effort.

Medicaid and Veterans benefits are two most common government programs that people turn to for help with the devastating cost impact especially for long-term care. They need much improvement and intervention by the government but are most unlikely to get its attention.

———–

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.