Crunching numbers? I am talking about getting ready to prepare for tax returns for 2019, of course. Like a bad penny, it comes back again and again, without fail, every year about this time. Since it is not going away, we might as well capitulate and be prepared for it.

Most of us have been doing taxes for a long time, few years for sure, so we know by now what to expect, where to get help, what paperwork and other information to gather, what software we prefer to use and most of all how long it takes to prepare such tax returns if we are doing it ourselves. This is important because we do not want to rush at the last minute like most procrastinators do and try to beat the deadline and then find out that we are out of time or that we made many mistakes.

This is the second year we are all working with the new tax law that was passed in December 2017; so we are getting used to the new rules somewhat. By now, the W2s, 1099s and other documents are trickling in. If you are itemizing then you will need much more information and many other documents to support what you are going to claim. But because of higher standard deduction now, the number of people who will itemize has dropped to about 10 percent from roughly 37 percent of all filers and that was the intent of the new law.

While the new law has changed the rules and taken away many things, it has also added some new benefits other than increasing the standard deduction. Earned income credit, childcare credit and Child tax credit are just a few of them that help the lower and middle income filers. Some of these credits are taken straight against the taxes which benefits the most because they reduce the taxes dollar for dollar as against when some of the benefits just reduce taxable income. Key thing here for the tax payers and the self preparers is that they need to keep an eye on such changes and make sure that they take full advantage of the new benefits.

There are many ways the tax preparer can get help. There are at least four different software packages that are available to use for such purposes, keeping in mind that all software packages cost money and then more money to file. These packages are good for most of us who do not have much preparation out of the ordinary but when things get sticky with your returns then you have to be careful with the package you get. Help is available but getting the right people to answer your questions is always troublesome and occasionally does not go smoothly. I have noticed that many times these packages don’t even guide you to optimize your tax refunds. A good example is if we have to file form 1116 to get the full credit for the foreign taxes we may have paid on our foreign dividends. If the tax preparer does not know about this and does not prompt the software to go look for the credit, it can be lost very easily. There are a few other examples like this. The main point here is that the tax preparer has to be well aware of what they should expect and are entitled to and make sure that the software is giving you that. Absence of right knowledge is very detrimental here.

If you have a very simple return, IRS would let you file directly on their website and you don’t need to own the software or pay for filing. But you have to go online and get on their website. There are other organizations like AARP who in co-operation with IRS run a volunteer program across the 50 states where they prepare return totally free for the seniors and indigent; but really anyone can walk in there and get their returns done free. There are over 35,000 such volunteers and they prepare and file about 2.5 million such returns (full disclosure: I am one of those volunteers) at 5000 sites nationwide. These volunteers have to go through at least 16 hours of class training and pass many tests every year before they are qualified to prepare returns for the season.

Many religious and other organizations also offer such free services.

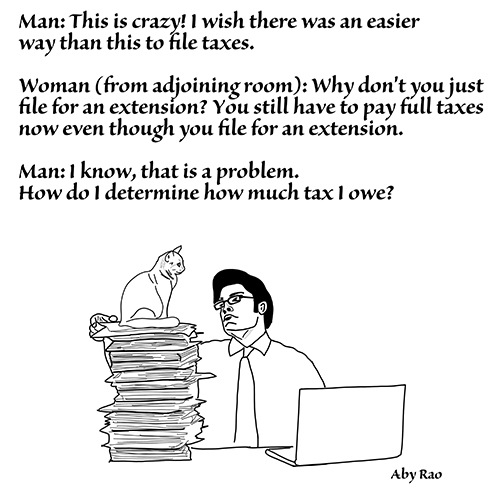

If you are absolutely not going to be ready to file by the deadline of April 15, then there are other options. You can ask for and easily get an extension to file by six months assuming that by then you would be ready to file. The only condition attached to this extension is that you still have to pay your tax due by the April 15 deadline. This is, in a way, a catch 22. You are asking for extension because you don’t have all the paperwork but still you have to pay all the tax due now which you cannot calculate because you don’t have the paperwork. How do we get over this? Well the answer is in estimating the taxes due somehow; usually from the previous years’ returns or pay enough extra so that you would not have tax due when you finally file.

Preparing for State tax returns is generally not paid much attention to. The reason is the same that we assume the software we are using will take care of it. But sometimes that is not the case and the tax preparer needs to be aware of and be watchful so that you don’t miss any deductions.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.