By Mo Vidwans

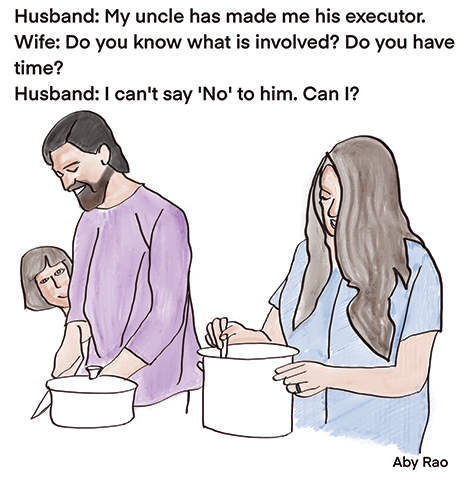

Many of us, especially the young, have been asked to be an executor to their friends’ or parents’ or some family members’ estate and of course we say yes out of respect, duty or sense of responsibility. It is always a good idea to have someone much younger than us for such function because, if nothing else, they are more likely to be around just by being younger.

But have we thought about what exactly entails when we accept that responsibility? It is one thing to say yes to such an assignment out of obligation or respect but it is another to be able to carry it out diligently when the time comes. There is much involved and it is time and energy consuming to say the least, if we can forget for now the frustrations involved. One thing everyone should know, especially the person who is writing you in their Will or Trust is that you do have a choice of rejecting the request when the time comes.

First, let us understand what the responsibilities of an executor are. If you have agreed to take on that function, then you likely have some idea/outline of the tasks you face. In its simplest form it is closing accounts, inventorying assets and distributing bequests and in general following whatever is mentioned in the Will or Trust.

This is easier said than done. Let us take an example of closing accounts. The Executor has to go find them, get death certificate and copies for it, go to the institutions and explain the situation and close the accounts and dispose the money. If the beneficiaries are already established on these accounts, then it gets easier. If the account has to be probated then it gets 10 times more difficult and so on. When one spouse dies and leaves everything to the other it is much easier but the paperwork is still daunting. When the other spouse dies and the estate has to be distributed to the children and others then it gets complicated.

Being an executor is not an easy job as the paperwork alone can exceed your worst expectations. The human side can be difficult too. The Executor may have to pacify impatient heirs and/or mediate domestic squabbles. Taking on the job is a true sign of devotion; and although one may get paid for it, it is primarily a labor of love.

Here are some steps you can take to help yourself do your job as efficiently as possible and reduce your own heartaches.

Read the Will before the grantor deceases, for as many times as you have to, and understand completely what the writer’s wishes are. You are not to question the intention but you need to understand the execution part of it and imagine the difficulties in doing that. One thing is for sure: once that person is gone you have no guidance or no one to clarify with, just the lines written on the paper that is in front of you. As difficult as it might be emotionally (and it is difficult) a sit-down meeting with the Will’s owner is necessary. Understand from the point of view of the writer: they are opening up their heart and soul to you, like they have never done it before, and not only you need to know completely what they mean but you also need to keep that a secret. It can get uncomfortable, undoubtedly, but it must be done. There might be surprises for you in understanding the writer’s wishes. Sometimes it is a good idea to suggest a meeting with all those affected so they know ahead of time or at least get the Will owner to explain in person. If not possible then it can also be done in a last letter of informal explanation, to be read after the demise.

Read the Will before the grantor deceases, for as many times as you have to, and understand completely what the writer’s wishes are. You are not to question the intention but you need to understand the execution part of it and imagine the difficulties in doing that. One thing is for sure: once that person is gone you have no guidance or no one to clarify with, just the lines written on the paper that is in front of you. As difficult as it might be emotionally (and it is difficult) a sit-down meeting with the Will’s owner is necessary. Understand from the point of view of the writer: they are opening up their heart and soul to you, like they have never done it before, and not only you need to know completely what they mean but you also need to keep that a secret. It can get uncomfortable, undoubtedly, but it must be done. There might be surprises for you in understanding the writer’s wishes. Sometimes it is a good idea to suggest a meeting with all those affected so they know ahead of time or at least get the Will owner to explain in person. If not possible then it can also be done in a last letter of informal explanation, to be read after the demise.

Do the necessities: after the death, nothing can happen unless the Will is located and filed with the probate court along with the death certificate and a letter of testamentary is obtained from the probate court which assigns you officially as the executor. This is when your work starts of closing everything down and later when the time comes distributing the estate as per the wishes expressed in the Will. At this stage of the game bringing the estate under your control is important so that you have a good perspective as to what is involved and what to do next. If a house needs to be closed and safe guarded, accounts closed, personal belongings checked and then disposed and other matters like SSA, Medicare or other health carriers, brokerage statements, Pensions, Credit cards, well, you get the picture. Much detailed work is to be done. On many occasions, relatives can come out of the woodwork claiming verbal promises and other expectations but you can only follow what is in the Will and hence it is necessary that all details go in it or in a statement associated with it.

Expect conflicts: Brace yourself for it; generally, it is not a bad idea to hire an attorney to do some of the work especially where emotions are involved. I always suggest that most of this work could be and should be done while the Will owner is still alive. This is quite hard to do emotionally but it has many benefits. All the people who expect something, get to hear it from the “horse’s mouth” as to what is coming their way. They can raise objections and hear the reasons why so and can discuss further. But the main advantage here is that there are no disputes that need to be resolved after the death of the grantor. Everything is reasoned out before and can help the make the executor’s tasks much easier.

Mo Vidwans is an independent, board certified financial planner. For details visit,

VidwansFinancial.com, call 984-888-0355 or write to: mpvidwans@yahoo.com