I am thinking about income taxes. Indeed, it is not too early to start thinking about them and have some plans ready to reduce taxes for this year, legally. For the tax year 2023, we would be compiling documents early part of next year (2024), long after the year 2023 is over, and filing them before April 15, 2024. The irony here is that we cannot do much at that point other than just compile, prepare, and file. If there is any thought of working on reducing taxes then the time to do something is now, before the year is over.

The other important aspect of tax planning is that much has changed/added for us to consider in taking advantage of (or just be aware of) tax point of view and I would think that it would behoove us to review and possibly take advantage of all that. Let us look at what has changed and how we can use it to our benefit. If I may just point out a few nuggets here of how people think about their taxes: They always think that tax-planning or optimizing is their accountant’s job and that tax refund is a good thing; both assumptions are not true. There are many more like these but I will not get into those at this time.

New 1099K reporting rules begin this year (2023); they should have started last year but IRS wasn’t ready and they pushed it out by a year. It is clear that more information has to be reported by third-party settlement networks such as PayPal, Venmo, eBay, Square and others. They must send out form 1099k to payees who are paid more than $600 a year for goods and services. Let’s say you sell an LP turntable and other similar goods together for $900 on eBay for which you had paid $2,300 initially. You will get a 1099K for this transaction, though this is not additional income for you because you just sold your own property. So, you would report $900 on schedule 1 as income on line 8z and then on line 24z, other adjustment on same schedule 1, enter the same amount to cancel out your unrequired added income. People in business would get many such 1099Ks and they would have to report those on schedule C.

New 1099K reporting rules begin this year (2023); they should have started last year but IRS wasn’t ready and they pushed it out by a year. It is clear that more information has to be reported by third-party settlement networks such as PayPal, Venmo, eBay, Square and others. They must send out form 1099k to payees who are paid more than $600 a year for goods and services. Let’s say you sell an LP turntable and other similar goods together for $900 on eBay for which you had paid $2,300 initially. You will get a 1099K for this transaction, though this is not additional income for you because you just sold your own property. So, you would report $900 on schedule 1 as income on line 8z and then on line 24z, other adjustment on same schedule 1, enter the same amount to cancel out your unrequired added income. People in business would get many such 1099Ks and they would have to report those on schedule C.

Reporting on 1099Ks doesn’t change taxation of the underlying transactions. All, or let’s say most, of these transactions were supposed to be reported even when the 1099K requirement was not imposed, but IRS’s contention is that they were not reported because it was not a requirement by law. Stay tuned, there is much to be learned about this new income reporting structure for small incomes; most of it was indirectly ignored by small business owners.

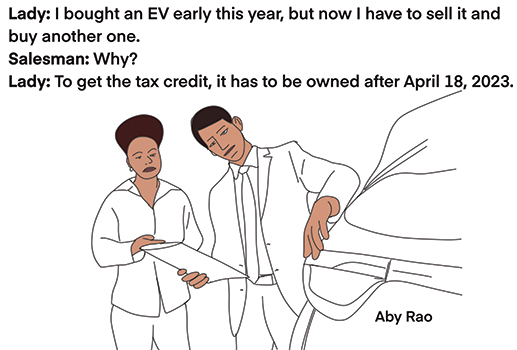

Buying a new electric vehicle this year? You are in for a pleasant surprise as long as you follow the two rules put down by the new Law. Strict critical mineral and battery component rules are now in place for EVs put in use on or after April 18, 2023. EVs that meet both rules can qualify for a $7,500 credit on your taxes; if only one rule is met then the credit is $3,750.

Here are the two rules: First, the final assembly of the vehicle must happen in North America. Second, some high-cost vehicles don’t qualify. The MSRP can’t exceed $55,000 for sedans and $80,000 for SUVs, vans, and pick-ups. I will assume at this time that this price limit for tax credit will move up every year as the auto prices crawl up. As mostly the case when taxes are concerned, there is also an income limit (MAGI) for qualifying for the EV credit. Check with your tax preparer.

Pondering over eco-saving upgrades to your home? You may qualify for one of two tax credits depending on the type of energy efficient system that you may decide to go for your residence.

The juicier tax credit is for the residential clean energy property credit for those who install energy system that uses renewable energy sources. Think in terms of solar panels, geothermal heat pumps, wind turbines, fuel cells or battery storage.

Clearly some of these improvements are not possible in an urban location but the credits are lucrative. The credit equals 30 percent of the cost of the materials and installation that you install in your home through 2032; after that it tapers off and expires.

Congress passed some smaller energy-efficient home improvement credits too; they had been around for years but Congress rejuvenated them beginning in 2023. Homeowners get up to 30 percent credit for the cost of certain type of insulation, boilers, central A/C systems, water heaters, heat pumps, exterior doors, windows and the like that they install in their homes until 2032.

There is a $1,200 generally aggregate yearly credit limit; this new limit replaces the old $500 lifetime cap. Also keep in mind that many specific types of home/energy improvements have specific limits. Again, check with your tax preparer.

Free filing, especially for low income and indigent people was available but not well serviced and was rather frustrating. It is being revisited by IRS. The program they have, at the moment, is free-file program in partnership with return preparation companies but there are plenty of problems and it is anemic, not simple enough to use quickly. The number of tax prep firms that sign up for such service has dwindled and alleged deceptive actions of some firms don’t help. All this and more has inspired IRS to ponder its own e-filing option; a digital direct-file tool that is mobile, friendly and multilingual. It remains to be seen how useful and friendly this tool would be, but I must say IRS is on a right path if it succeeds.

Mo Vidwans is an independent, board certified financial planner. For details visit, vidwansfinancial.com, call 734-476-0579 or write to: mvfinancial@yahoo.com