Yes, I know; if you could help it you probably do not even want to think about taxes again till early next year. I would not blame you: a majority would feel the same way and I am no exception to that.

But you have to recognize the opportunity and this one is time sensitive. In the sense that whatever changes you wish to make to your income and/or deductions you have to think, plan and make them while possible, which is in this calendar year. Once we get close to the end of the year, and definitely once the ball drops in Times Square, it is too late and is an opportunity lost. So, while your tax brain is still percolating, ideas are fresh and you have the energy, get it done and put it out of the way.

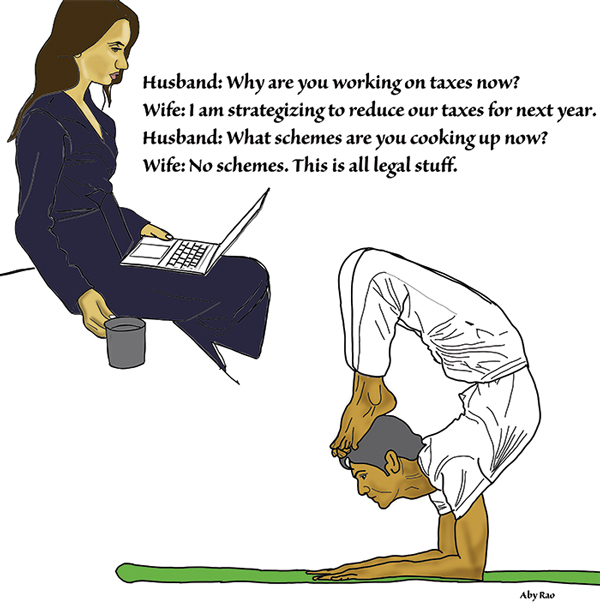

I am talking about tax planning, thoughts on how to get our taxes lowered legally and pay only what we have to. There is absolutely nothing wrong with that as long as we stay within the framework already established by the tax laws and IRS’s guidelines. The new tax laws of 2017 (TCJA) and 2019 (SECURE) have forced us to take a second look and it behooves us to consider what is still possible and what is not.

Itemizing

Courtesy of the 2017 law, we all have begun to realize that using the itemizing option in preparing tax returns is increasingly difficult. If you felt that way you are not alone; millions of tax payers felt that way because they had to abandon the itemizing part and go for the standard deduction. It is nice that the standard deduction has gone up, almost doubled in fact, but for some that still does not make up for the extra taxes they had to pay.

What can we do? We can indeed do something. The itemizing with the law of 2017, consists of medical expenses, State income taxes and property taxes, mortgage interests, donations and nothing else. So, what can we do with that? We could definitely try to move some of these expenses around so that most of which can be bunched in one year. Easiest example is with donations. Let us say you donate cash worth $5,000 to your favorite charity every year. Generally, most of the donations happen in the last few months of the year. If you can push your donations for 2020 in Jan 2021 and do the same for donations for 2022, which means bring the donations for 2022 forward into Dec. of 2021. So what happened here? You have no donation in 2020, large donation of $15,000 in 2021 and no donation in 2022 again as shown in the table below.

| Normal | New | |

| 2020 | $5,000 | $0 |

| 2021 | $5,000 | $15,000 |

| 2022 | $5,000 | $0 |

What this will help you do is bring your itemizing donation in one year when you can actually itemize because you could exceed the standard deduction and for the other years take the standard deduction. This is just one example and it alone may not help but if you are able to do similar moves for some of your medical expenses, property taxes and mortgage payments, they will add up to help you cross over the threshold of your standard deduction for every alternate year.

Now the point I was making earlier was that if you indeed wish to do something like this then you have to plan ahead and that planning would not be possible in January of next year or for that matter in December of this year but it should be done just about now.

If you do RMDs

I am sure you are aware of the fact that you can donate part of your RMD directly to authorized agencies like UNICEF, Red Cross etc. and reduce your RMD income on your taxes accordingly; this is called QCD (Qualified Charitable Donations). What it does is that if you are donating money anyway then donate it via this vehicle and it reduces your AGI (Adjusted Gross Income) and hence affects your taxes directly. If AGI is lower then it affects many other calculations as well. When this is done then of course that donation cannot be claimed again in itemized deductions; hence it works out really well when you cannot itemize.

Other credits and deductions

Congress has recently enacted a bevy of tax credits and deductions for non-itemizers. One of the reasons to review it now is that you get enough time to not only put your thoughts together but you also get plenty of time to put all actions necessary in place and work on it before the year is over. If you became a parent you will be eligible for a $2,000 tax credit. If your children are younger than 13, you are eligible for a credit of between 20 percent and 35 percent in child care for a max of $6,000.

There are several “above the line” deductions for non-itemizers. In contrast to the earlier ones, which were tax credits, these reduce your adjusted gross income. A contribution to an IRA is the most popular tax break. Relief for taxpayers with student loans is another one. Contributions to health savings account (HSA) are deductible too but you must have an HSA-eligible health insurance policy to take that.

There is no substitute for advance planning and it is never too early. You will be surprised how many different ways you can save on taxes if you just don’t rush at the last minute and keep working on it methodically. Now is a good time to start.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.