Can you retire at age 40 or is it a trick question? What is FIRE and what does it have to do with retiring?

FIRE is an acronym and it means Financially Independent, Retire Early.

PBS put out a nice 20 minute segment on it a few months ago. The Wall Street Journal had a big article on this as to how so many people are practicing it and actually retiring before they turn 40. There are many other articles and books about the subject. There is much interest in this aspect of lifestyle and many people are actually reaching that goal. It does need much mental discipline and other qualities to carry it out and we will talk about it here.

Two things are certain if indeed you wish to retire around 40. First thing is that for the period during which you are working (for the 15 to 20 years of your working life) you have to save like crazy (like 75 percent of your take home salary) and secondly once you accumulate enough and retire as planned you have to have unwavering discipline to control your manageable expenses. If you think you can manage both of these ideas successfully, then you are in. I also should mention that the buy-in from your spouse is also a must.

The concept is simple and feasible (albeit with lots of caveats). We all know the stress of daily routine of getting up early, feeding the children and the pet(s), get ready, fight the traffic, and then navigate the stress of intangible competition at work with no real moment to stop and just enjoy a few diversions. You later come home and finish the rest of the chores of usual household duties. You get the picture. I don’t know anyone who does not have this kind of stress occasionally, if not all the time. Health problems and other unexpected happenings add to it.

If and when you quit working, some stresses go away for sure but we could add some others. I will touch base on that later.

If FIRE is to really come true, then much advance planning is required as a prerequisite. Depending on where you live and where you plan to retire, unless you are able to save at least about $1.5 million, you should not even contemplate such a move. Most people will need much more than that. It would not happen unless your savings rate is indeed 75 percent or thereabout and you can continue with that for a long time. It is clear that you have to drop out of the rat race of needless spending. It does need a totally different mindset and both spouses have to think alike and be on the same page in this regard.

Under normal circumstances, when we retire we are around 65 and we have a span of 25 to 30 years in front of us for which we have to account for financially. When the retirement is considered at 40 under the FIRE scenario, all of a sudden we have a lifespan of 45 to 50 years in front of us that we have to account for, almost double what would normally be the case and hence the calculus changes. Not only the money we have saved should last that long comfortably but also that some of the other assumptions we make about our life like Medicare, social security, additional health or insurance coverage would not come in the picture for a long time and we have to account for that in our calculations.

Medicare would eventually kick in at 65 but social security benefits would be minimal because it is based on about 15-18 years of your working career and not on the best 35 of your 45 years of working life. Until Medicare enters the picture, we have to account for the health coverage ourselves because it is not provided and subsidized by any corporation.

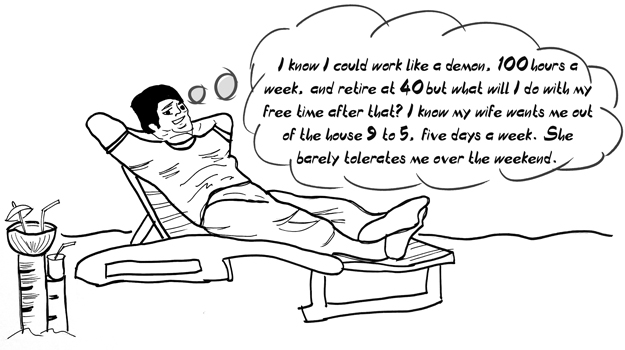

Those were just a few of the hurdles to cross on the financial side. On the social and emotional side there are many more yet. The idea of 24/7 face time with all the immediate family members could create different issues. And this is going to last not just for a year or two but for a long time. It could work just the opposite way too and create a solid bond that we would not expect when we were working 40 or more hours a week. Knowing our emotional make-up and all the family members is a plus in this regard. When so much free time is available, it almost behooves us to have outside hobbies or at least a plan as to how the free time would be handled.

One more peril to be considered is the fact that if for some reason one has to go back to work either part-time or full-time, how applicable would your skills be at the time when you re-enter the workforce. Considering how fast the world of technology is changing it could be a monumental task to retrain and become employable.

Because of this reason many folks don’t completely quit the work force but still keep their fingers in the pie by either keeping a part-time job or work from home as an independent contractor. Whichever way it works out it sure takes away the thrill of forsaking work completely.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.