For the year 2019, you will not pay any income taxes on capital gains (0 percent) if your taxable income is at or under $78,750 for a couple filing jointly or at or under $39,750 for most singles. Of course, for a majority of us that is a rather low limit but there are many who fall in that category, believe it or not, especially if they don’t have any assets which are invested in stocks and similar equities.

Per the new tax laws passed in December 2017 and under which jurisdiction we all have already filed our taxes for 2018, the next capital gains tax rate step is 15 percent and the limit for that stretches out to $488,850 for married filing jointly or $434,550 for singles. This is a giant step, one that covers most of us (almost 99 percent). After this the top rate is at 20 percent.

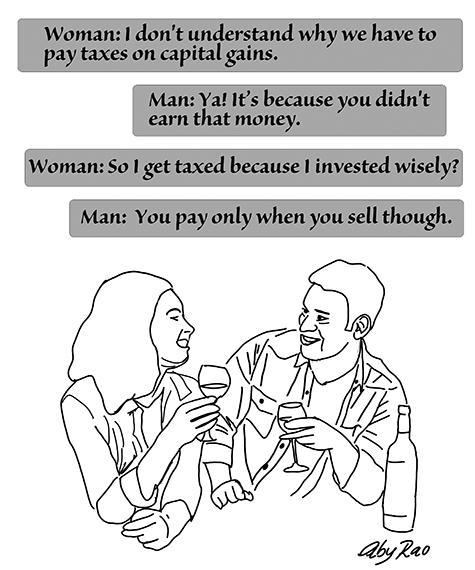

Considering the information above, by the tax law standards, the rules on capital gain taxes may appear fairly straight forward, especially for those who pay zero gains taxes. But many others, particularly upper income investors often find the tax law around capital gains more complicated than they expected.

For starters, the 3.8 percent surtax on “net investment income” comes in the picture for joint filers with modified adjusted income of more than $250,000 and for most singles above $200,000. As you can easily see, that does affect people in both 15 percent and 20 percent brackets and effectively raises their top tax rate to 18.8 percent and 23.8 percent respectively. Net investment income is defined as all passive income such as interest, dividends and much more but not capital gains and qualified dividends.

There are several other twists which will not affect most of us but they do affect some and we can easily get tangled in that under some circumstances. A maximum of 28% on capital gains for arts and collectibles. There are also special rates for certain depreciable real estate (rented property etc.) and investors with certain kind of small business or private stock may face different music because those stocks are valued differently. I think we all know there are special rules of taxing appreciation when we sell our primary residence.

A crucial factor of investing is managing how much tax we will end up paying on our realized capital gains; taxes are sometimes overlooked or considered after the fact but capital gains can have a big impact on investment results. It should be made clear that there are no taxes to be paid on ‘unrealized gains’; in other words, if you own appreciated property but don’t intent to sell there are no taxes to be paid. To qualify and get favorable tax treatment on capital gains taxes we typically have to hold stocks or bonds for more than a year; held exactly a year or less, the gains will be classified as ‘short-term’ and taxed at our ordinary income tax rate, whatever that may be. Making sure that we cross that one year threshold is important from the tax point of view. The tax rules get more complex when investors use options, futures and similar strategies. IRS publication 550 has all of the above details covered.

The new tax law of 2017 does change our thinking on giving donations but generally donating shares of highly appreciated stocks and certain other investments held more than a year is a good idea because donors can deduct the appreciated market value of the stock and don’t pay any capital gain taxes. By the same logic, if the stock has declined in value, it is best to sell it yourself, take the loss on your taxes and then donate the cash proceedings.

That brings us to the next point of balancing the gains against the losses and let the losses soak up the gains at least for the tax purposes. Investors whose losses exceed gains can deduct the net losses from the ordinary income up to $3,000 every year. If the losses are over $3,000 they can be carried over to the next year(s) indefinitely, until our death, taking $3,000 every year. After death the losses wipe out. It should be pointed out that while reducing taxes is an important strategy, investment decisions should be based on a solid long-term investment strategy and not just on saving taxes for that year. Tax management is not something done only at the time of preparing tax returns but it should be a year round thought process and it is not an exaggeration if I say a life long process.

Taxation on gains from bonds have some common characteristics with stocks but there are differences too. If an investor buys a bond at par value and holds it to maturity, there will be no capital gains on the transaction. However, if an investor sells before maturity and generates a capital gain or loss there is some tax implication, either short-term or long-term, the same as with stock. The big difference with bonds is the interest (coupon) payments paid to the bondholders. These are similar to dividends but interest on bonds is taxed very differently depending on the type of bond. Interests on Corporate Bonds are subject to both Federal and State taxes. Interest payments on Federal Bonds are subject to Federal taxes but not State taxes. Municipal bonds are the real winners; their interest is not subject to any Federal, State or local taxes, when the bonds belong to your own state. Naturally, because of this tax advantage their interest rates tend to be low too.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.