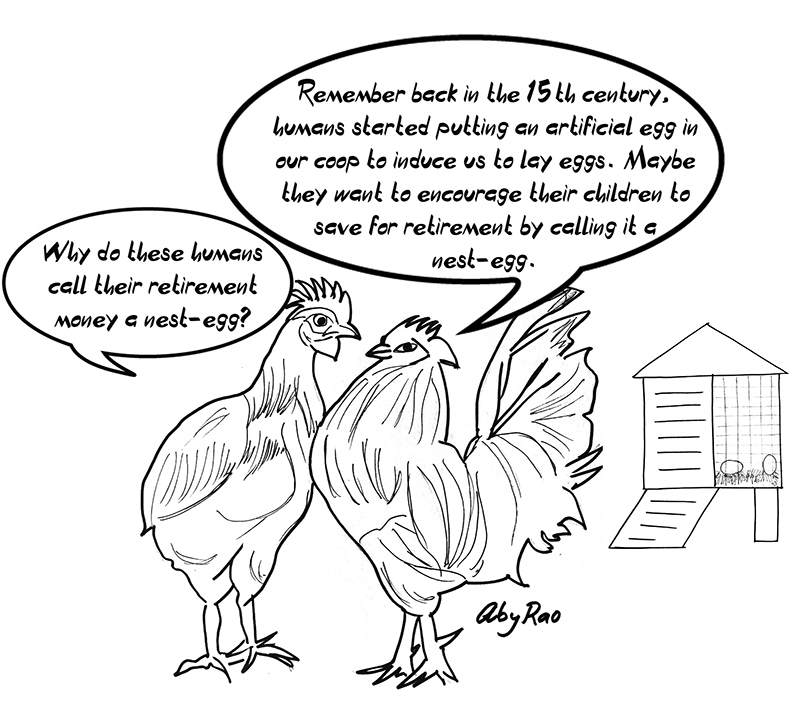

When we start working for the first time, right out of college or high school, there is so much excitement that we probably don’t pay much attention to how we are going to build our nest egg, may be because it means actually thinking about retirement. It is so far out in the future, at least 45 years if not more, that it is almost unfathomable, like a bottomless well where nobody knows or can figure out how deep the well is. So why bother?

It so happens that it is actually a good time to think about retirement and the nest egg we are supposed to start building for. The reason is very simple. We all have heard the power of compounding. One thing a newly minted employee has on his/her side is the time; and the impact of time, if harnessed properly, can do great things for him/her and hence that is the time the real hard thinking for retirement should start. What does that mean? Talking about power of compounding, there was an article by Amit Rupani in this magazine in March 2019 which gave an excellent demonstration of how the compounding works even if you just invest for the first 10 years of your career and then stop investing.

Well, let us start with obvious things first. Your 401k plan at work. Most Corporations have these plans and generally you are automatically enrolled unless you opt to get out of it. If you opted to get out that will be at your own peril and a pretty bad move. Not only should you invest in 401k, but you should invest to the fullest that the law and the Corporation allows you to do (2019 limit is $19,000 for younger than 50 person). Yes, even if that means a bit of belt-tightening or tight wallet for the first few years. It is worth it because it assures you a certain amount of money at the time of retirement and it is a good investment. Not only it is tax-free but also most Corporations will contribute free a certain amount to that. It is also portable which means it is your money and you take it with you should you decide to change jobs. If you and the corporation together are able to put $510 in to this account every month, at 6 percent growth you will have over a million dollars ($1,015,660) at the end of 40 years in your account. Just make sure that you always take advantage of the full benefit offered by your employer.

Besides the 401k, you can also start your own IRA and invest up to $ 6,000 every year. The story here is the same: take full advantage of the plans offered so that the compounding effect of time, as mentioned above, will benefit you. There are income and other limits on IRAs.

Those two will be the main sources of income for you in your retirement. Aside from those the only other steady source is your Social Security. The FRA (full retirement age) for getting fully vested benefit is around 66 right now and would slowly keep creeping higher until it reaches 67. I would urge everyone to at least wait till then if you absolutely cannot wait till your age of 70 which would be the best scenario for you to reap the most benefit from social security.

One harsh reality many don’t realize is that the income stream stays very steady and the same once it starts with the exception of social security which is adjusted for inflation every year. It does not matter how many years you have in retirement (5, 20, 35 or more) this income stream does not change but the expenses keep going up every year at least by the inflation, some times more. Just imagine if your monthly expenses are $1,000 today, as an example, for the same items that you buy with that money you will be paying $1,100 five years from now and $1,220 10 years from now at just 2 percent inflation; If the inflation is assumed to be 3 percent then the same numbers go up to $1,160 and $1,340 respectively. The Federal Reserve is trying its best to contain the inflation at 2 percent. But let us just assimilate the fact that inflation effect is real and dangerous and is here to stay.

So, it becomes a major issue in retirement to make sure that our expenses stay under the income stream we have. If it is not possible to contain/reduce expenses for whatever reason then we have to increase our income stream which means tapping into and possibly depleting our other (taxable) savings. It is easier said than done. It is so because you have to make sure that the withdrawal rate is such that the assets will last your lifetime, but then we have to decide our “lifetime” which may be a hard thing to do. It is also possible that you can withdraw more than your RMD from your 401K/IRA accounts but the same lifetime question would boggle that scene too. You also need to keep in mind that you don’t creep into higher tax bracket when more money is withdrawn from these accounts.

We haven’t talked much about many aspects of saving for nest-egg; like long term investment strategy, when, where and how to invest, your own risk tolerance and other estate planning necessities but that will be left for another time.

It is possible to retire happy. But much effort is required behind that statement. And that effort starts when you start working. Yes, indeed, as mentioned above it behooves you to have a plan, preferably on paper but at least in your mind for sure, and follow it. It will be wise to take advantage of the compounding effect of time by investing early in your career. Also, it helps to have a streak of discipline.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.