We all have our own specific interests, goals and ideas and we follow them with great zest, deep involvement and dedicate much of our private time to it. Generally, most of the hobbies that people follow fall under this category (very rarely they convert that into a business); some collect things, some have interests in stamps, dolls, records, rare books, baseball cards, cars – especially antique cars – and so on. The list is long, but it is clear if we generate specific interest in a subject, we do dedicate ourselves to it. This makes me wonder as to why is it that a subject like finances, something that will affect us all the way to our grave, does not generate enough enthusiasm to dedicate more time to it. Even a little bit of financial literacy will go a long way and will make your family’s financial life much more pleasant.

Financial Organizations put out many programs (lectures, talks, shows) to generate interest in financial literacy. This is done to get more people involved, get them interested and at least take a second look at their own situation. While many of you reading this are financially literate, I am sure, a significant number of Americans are not. Financial literacy is not limited to USA either, the lack of it is documented in many other countries as well.

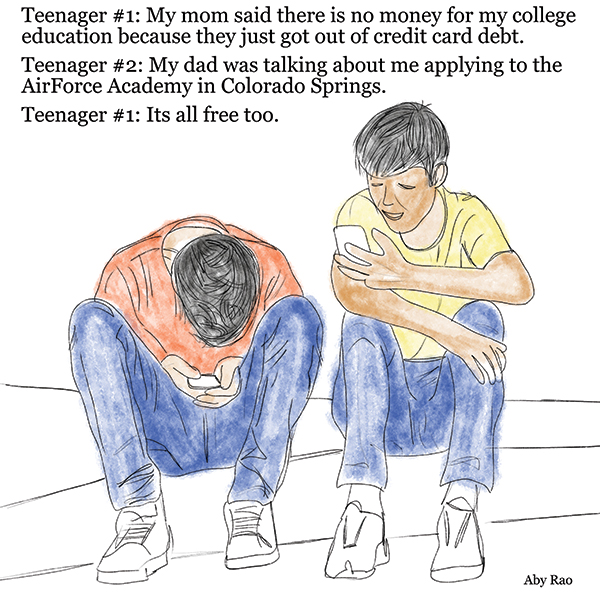

I am going to touch on only a few key concepts here. The concept of compounding is one of them. This subject has been honed here before, in this column by me and by other articles in this magazine. This is a simple but very powerful concept. If you invest something today and let it grow at a steady but compounding rate it accumulates so rapidly after a certain length of time. And you don’t have to do anything more than just start the process and don’t disturb it. Compound returns are why investors are encouraged to allocate wealth to stocks. Realizing returns on capital appreciation (which is not taxed until you sell it) and reinvesting dividends is what makes stocks a key creator of wealth especially when you have a distant horizon. On the other end of this scale, debt has the opposite impact on wealth. Fail to pay down the principal and the interest charged will drag you down into a much bigger hole and that makes it that much more difficult to climb out of. Those who have dealt with credit card debt and payday loans will understand this well.

Another aspect to financial literacy is “retirement readiness.” Topics in this category include when to claim social security, the relationship between risk and yields, question about when one should start thinking and saving for retirement and how much (hint: one should start thinking of retirement the day one earns his first paycheck), how to save for children’s education. This also includes how much can we maintain our lifestyles in retirement, how, when and where to invest. There is no end to these questions. They are as varied as there are people. But they all can be answered and understood well if one shows some inclination/literacy towards financial matters.

Out of more than 1200 adults surveyed by the American College New York Life Center for retirement income, just 5 percent scored equivalent of B grade or higher. Worse yet, nearly three-quarters of these respondents failed the quiz. This is troublesome because even today about 10,000 baby boomers are retiring every day and marching into that haze and mental fog of financial illiteracy.

Think for a moment of a 65-year-old person who has not spent time educating himself or herself about how best to transition into retirement. At that age they must make decisions about Medicare, social security, expected incomes and expenses, health matters, investment allocations, RMDs, tax implications and much more. These are all big issues and need to be thought of long before the age 65.

Financial literacy, once we have the interest in it, can bring forth the most important aspect of retirement, which is planning for it. And as mentioned above, unless you know you are going to inherit wealth, planning starts the day you start working and earn your first dollar. There are twelve aspects to that planning (which we may cover in later article) but the most important one is the acute awareness of it and a strong desire and urge to do some thing about it. Half the solution to any problem is defining the problem properly. If you are working on fixing, say, a broken appliance, half the time goes in deciding what is broken (or wrong); once you determine that fixing it is the other half which is relatively easy.

Majority of people are heading into their retirement years without a plan. They are going to make mistakes. Some mistakes may be correctible (e.g., deciding where to live in retirement) while some mistakes will have consequences for the remainder of their retiree life (like starting social security too early or withdrawing too much money during the first few years of their retirement). Maybe they will learn from their mistakes and pass the word on to the next generation and make them wiser (if they care to listen) but the point is that not all mistakes we can recover from unless we start early, way early, and never lose focus of what our goals are.

Just like the other hobbies we have and are so serious about, make financial literacy a hobby activity and you will be in for a pleasant surprise when the time comes. Well, your next generation definitely would be.

———-

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to mpvidwans@yahoo.com.