We all aspire to do well, to take care of our family, get our children the best education, keep them healthy and give them all the tools and incentives for the most healthy and wealthy life. There is nothing wrong with that at all. But when I start probing a bit more about “how to reach those goals” then the puzzlement and head scratching begins. And that is because we have some vague idea, not quite crystalized, and we also don’t act on it. Having talked to so many clients, young and old, I have put together the following 12 bad habits (presented in two parts) that everyone must avoid, and these will also be useful in getting your financial life in order.

1. Not having a plan for life: No matter what age you are, it is necessary to have a plan; perhaps not on paper yet but it should be vivid in your mind which means you must have thought about it seriously. To have a plan, you must have a goal to get to. It can be as general or as specific as supporting children’s education, retirement goals or starting a business or owning a house or even dedicating yourself to a humanitarian cause. One has to have a goal that you know you are going to accomplish one specific day and then a plan as to how we are going to get there. It is very common to have more goals. It does not matter what age you are either – young or looking forward to retirement. Many young people think that it is not necessary to think about one’s retirement (as a goal) until you get close to retirement but that is like being on a boat cruise without a rudder or driving your car with a muddy windshield.

2. Not saving every month: No matter what, strive to save some money every month unless the circumstances are absolutely out of hand. This is a matter of habit and creating discipline for ourselves. But getting into a habit becomes easy once it becomes a rigorous discipline. I am not talking about the regular 401K and IRA savings or your emergency fund; I am thinking of something on top of that. Why should we do that is the obvious question. Isn’t the non-taxable saving enough? Simple answer is in most cases it is not; we must save more to support a comfortable lifestyle or whatever other goals we may have decided upon. This goes hand in hand with item no 1 because once we have a plan it necessitates the need for further action (like saving more) and all such other requisites become clear.

3. Control your expenses: This can be treated as a corollary to the point above of saving more; they do go hand in hand because unless we control our expenses, we will not be able to save. On many occasions I ask my clients to make a list of their monthly expenses, all of the expenses they can think of; just keep a list of your expenses for at least six months. They get surprised when they see what they are spending on; not only that, they see also how unnecessary some of those expenses are. Sometimes we get carried away competing with our neighbors, friends, relatives or colleagues but the key questions to ask: Is that particular expense necessary? Not suggesting that on some special occasion money should not be spent but there must be a rationale behind it as to why we are doing it. This is definitely a key factor and much conversation needs to happen here.

4. Not fully investing in non-taxable retirement plans like 401k or 503B and IRAs: Almost 70 percent companies don’t have pension plans any longer; instead, they have switched to 401K plans and in doing so they have made their life a lot simpler. But that is beside the point right now. If a 401K plan is offered, then all of us should be fully invested in that to the fullest level possible by the Law. An employee under the age of 50 can invest $19,500 per year in that plan; $26,000 for 50+ group. The corporation will match, up to a limit, every dollar you invest. It is easy money for you to take advantage of and everyone should be doing it. It is equivalent to committing a serious crime if you cannot grab that match offer by your corporation. The same thing goes for the IRAs that you and your spouse can invest in; there is an income limit on the IRA investments.

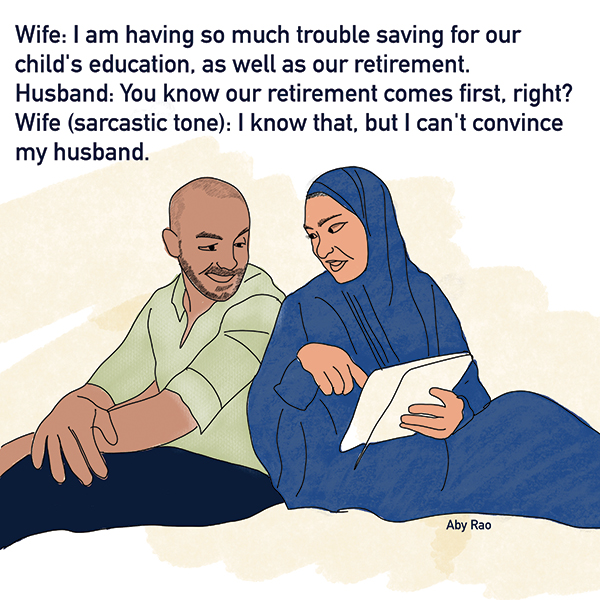

5. Planning for children’s education before your retirement: I get a puzzled look when I say something seemingly silly like this. I am not suggesting at all that children’s education should not be planned for, but I am suggesting that plan for your own retirement before you start saving for your children’s education. From parents’ point of view this is an emotional issue and they get mad at me when I say this; but the reason is very simple. There are many avenues open to support children’s education: there are scholarships (merit or special), there are loans and other support, there are grandparents who are generally eager to help; children can support themselves, by working part-time, and still go to school. There are many ways their education can be helped; but I have not heard of anyone, any bank knocking on my door suggesting that they are willing to loan me money for my retirement when I stop working at 65. Parents must think 10 times before they cash out their retirement account to support children’s education.

The remaining seven bad habits will be covered next month in Part II.

———-

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to [email protected].