The term “Kiddie Tax” was coined back during the Reagan Administration era in 1986 when a special tax law was created dealing with unearned income of essentially kids under 14 years of age. Children under 14 legally cannot work which means any income the child receives usually comes from dividends and interests and other indirect means; certainly not earned by the children. It was determined that many wealthy families were using a tactic of transferring some of their assets to their children in order to avoid high income taxes (or at least reduce them substantially) on the income from these assets which they would have to pay if these assets were still on the parents’ own name. Back then the tax structure was quite different than today and highest tax bracket was much higher for adult individuals who would have normally owned these assets. The tax structure for unearned income of children has evolved a few times since then; the last one being when TCJA was passed in December 2017 making it effective for 2018 and onwards.

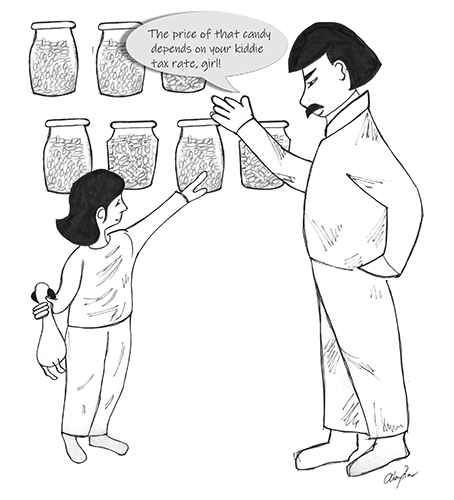

So today, Kiddie Tax is a tax imposed on individuals under 19 years of age (24 for full-time students) whose unearned income exceeds an annually pre-determined threshold. Before 2018, the IRS taxed any income exceeding the pre-determined threshold at the rate of the income tax rate of the child’s guardian or parents; in effect making the transfer of assets to children a fruitless exercise. Under the old law it also created some strange situations; for two children who made the exact same amount of income in their portfolio, their unearned income could be taxed differently depending on what income bracket their parents fell into. A child whose parents made $75,000 that year, for example, would be taxed at a significantly lower rate that a child whose parents made, say $200,000.

The TCJA of 2017 greatly changed the thought process behind the kiddie tax. Now, with the new law in place, when a child’s income exceeds a certain threshold the kiddie tax uses a taxation structure where the amount of unearned income dictates the tax rate rather than the tax rate of the child’s parents. Now it is completely independent of the parents’ tax rate; the new rules totally disregard the income of the parents.

In the old Law (till 2017), the tax-free income threshold was set-up at $1,050. What it meant was there would be no income tax the child has to pay on the first $1,050 of his/her unearned income. After that IRS taxed the second tier of $1,050 of unearned income at the child’s tax rate, which would be generally very low, sometimes even at zero percent. Any income exceeding $2,100 ($1,050+$1,050) was taxed at the guardian’s tax rate which could have been as high as 39.6 percent cascading through the various tax steps.

According to the Internal Revenue Service Data, which is available for 2015 now, about 343,000 children paid a total of $1 billion in kiddie tax; this was calculated by the old rules, of course.

Starting in 2018, with the new TCJA law in place, a simplified but different kiddie tax structure is in place. In the new form, the kiddie tax stays the same for the first $2,100 of unearned income. But after that IRS will tax the unearned income amounts at the rates associated with the different income brackets as opposed to associated with the parents’ tax rate. The rates range with anything up to $2,500 taxed at 10 percent, from $2,551 to $9,150 at 24 percent, $9,151 to $12,500 at 35 percent and anything over $12,501 at 37 percent. This means that children in the top bracket whose parents make less than $600,000 when filing jointly, are going to be subject to higher tax rates than their parents. The Kiddie Tax does not apply to child’s earned income like from mowing lawns, designing websites or fixing cell phones; these are just a few of the myriad of things children do which will be classified as earned income. For earned income they will have to file their own tax returns like everyone else does.

These rates mentioned above suggest that a child’s unearned income will be subject to something similar to Trust Tax rates. As mentioned before, this income was usually taxed at the parents’ rate.

It is worth noting here that it does not matter in what kinds of vehicles the investments for the child are placed. It can be inside a child’s UGMA (uniform gift to minor’s account), regular investment account (broker/dealer) or a simple savings account, inherited traditional IRAs, or 401Ks, a taxable legal settlement or even social security survivor benefits in some cases; you get the picture. It makes sense to think that it is often better to leave a child a ROTH IRA, which can make tax-free payouts, rather than a traditional IRA if the child would owe kiddie tax on the payouts.

Parents, or the child, have to choose investments carefully. The $2,100 total can go a long way. It could essentially shelter the current annual dividends from say, $100,000 invested in an S&P 500 index fund. The dividends from a high growth stock in a single company could also be less than $2,100 a year. But be aware if the company undergoes a taxable merger, like Medtronic and Johnson Controls did a few years ago, there is almost certainly a large capital gain in such situations which would trigger kiddie tax.

As you may have guessed age makes a big difference. The kiddie tax does not apply to children older than 24 or who are married. Some part-time students also don’t get affected by it and there are other exceptions. Perhaps the best thing is not to sell a gift of stock immediately. Check your dollar needs, the time frame and, for sure, tax situation.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to [email protected].