Insurance is an encompassing word and it means many different things to different people. As a Financial Planner, my focus here is going to be about all the insurances that a family would need. I am sure you all realize that the insurance needs are quite different for the various stages of our lives. This may come as a surprise to some because a common misconception is that once we have picked our insurance needs now when we are young then we don’t have to look at it again. Nothing can be further from the truth. I will explain.

Why do I Need Insurance?

Another question I get asked rather frequently is “why do I need insurance?” In other words, why do I need to spend all that money on the premiums? Actually the answer is embedded right in the definition of the word Insurance. And the answer is simply that we don’t know much about the future and we can never be able to predict with any degree of certainty what will happen tomorrow. All roads of such uncertainties (risks) lead to insurance. We cannot predict what will happen in the future but we can certainly plan for it by covering ourselves for such mishaps. That is the best we can do next to avoiding mishaps. The best insurance is the one that you never have to use. The lottery of Life can be well mitigated by applying the Principles of Financial Planning and Insurance is a key part of it.

Insurance needs do change substantially as you advance through life. When you are young and single, with no care in the world, you probably don’t need any insurance, except health, unless your parents think otherwise for all the pains and suffering they have gone through to raise you right and buy insurance on your life.

The real need starts when your family comes in the picture. You have to make sure you provide for them adequately if you die suddenly, for example. As morbid as these thoughts are, those things happen and we need to be ready for it. It is traumatic as it is with you not being around but at least the family is well taken care of financially; that should be the goal. My contention is that all young families should/must have health (goes without saying), life (for long term support) and disability (short term support) insurance. Auto and home insurance are a must as long as we own one of those.

All those who are employed generally have health insurance. Consider your and your family’s needs, especially if there are any special needs, and then choose a program accordingly. Nobody should be without health insurance. Even if you are temporarily unemployed, or for any reason cannot get health insurance through your employment, please make sure you have health insurance either via private means or through the Market Place. It could be a touch expensive but not having health insurance could be much more expensive.

Health Savings Account (HSA) is a good option to have if offered at your workplace. It has many benefits for long term and I would urge everyone to consider that. Usually it is high deductible but low premium insurance and for a young family that may just fit the bill. The money in a HSA account is like an IRA; it grows tax-free, it is portable and it can be used for distribution even after you are over 65. Besides, any body in the family can contribute to it while you have it.

To cover your family’s needs, as mentioned above, life insurance too is a must. Assuming you are in good health and you plan on keeping yourself in good health by following an exercise and diet routine, Term life policy is the best one to have. Calculate your needs for your spouse and the children until the youngest one is out of college (and on his/her own) and that is the insurance value you need to have; generally it is not less than million dollars.

For disability, the statistics is that between the age of 25 and 45, 35 percnet of the population will go on at least a temporary disability, which is 3 to 9 months. The thinking behind the disability insurance is the same as life insurance; you get disabled albeit temporarily, income flow stops and this is where the disability insurance kicks in. The need for this diminishes when the children are adults.

Insurance Needs Change with Age

As we get older and the kids leave the nest, need for some insurance certainly goes down and we need to act accordingly. Life and disability may not be needed for purpose it was initially bought but new needs may arise. Auto and home needs continue until you have any one of those.

We all have this misconception that auto accidents, serious health issues, sudden death, unexpected disability and any such mishap will not happen to us and they happen only to others. It is our prerogative to carry this impression, if we must, but only when we are prepared for those sad events just in case. You have heard the old saying “Man proposes and God disposes.” So cover your foibles and misconceptions with proper insurance.

Shop Around for Insurance

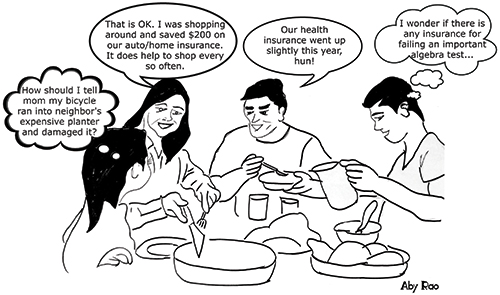

One thing I must point out to you before I stop. I have preached time and again that for all these insurances we must go out and shop around for fresh quotes every three to five years. Finally, I had to swallow the bitter medicine of my own advice recently.

I started noticing that my auto and home insurance premiums are going up and for no obvious reasons. I started comparing my previous years’ statements and noticed that they have been inching up and up every year ever so surreptitiously. So I started shopping around and got much better quotes for the same or better coverage. A sound wake-up call indeed.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to [email protected].