By Mo Vidwans

There was once a craze called Day Trading. I’m sure some people are still doing this. These traders were just buying and selling hundreds of shares daily, sometimes multiple times, and expecting to make some profit. Making profit got a bit easier for these people when the trading commissions dropped to practically zero. I still have a big question in mind, though, whether this was just an emotional high or were they really making any profit.

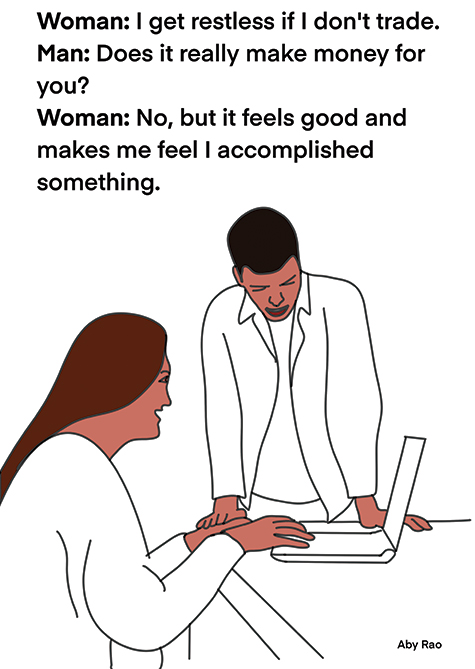

The real question we need to discuss here is if there is any value in frequent trading. Everyone has his/her own experiences and stories to tell but most of the Gurus in the business will suggest otherwise.

You may have heard of Jack Bogle or may have read about him. He died in 2019 at a ripe age of 89 but he is most known for two things. He invented Index Funds, and he founded the famed investment firm Vanguard in 1975. He has written many books, of course, but that is not as important as his life-long teaching as to how one should invest and save money while doing so. That was the concept behind creating Index Funds.

One of the things Bogle used to say is “don’t just do something, stand there”. This may sound crazy and in fact just the opposite of what our forefathers would say which would be “don’t just stand there, do something”. It sounds silly hearing such a contrarian statement from a person like Bogle but what he meant was, and I’m paraphrasing, once you have a plan, don’t deviate from it. And he was talking about your investment plans. His thinking behind the Index Fund was just that. He was convinced that his line of thinking was pertinent for long-term investing. Of course, at the time, the rest of the industry was dead against it (we will talk about this a bit later).

One of the things Bogle used to say is “don’t just do something, stand there”. This may sound crazy and in fact just the opposite of what our forefathers would say which would be “don’t just stand there, do something”. It sounds silly hearing such a contrarian statement from a person like Bogle but what he meant was, and I’m paraphrasing, once you have a plan, don’t deviate from it. And he was talking about your investment plans. His thinking behind the Index Fund was just that. He was convinced that his line of thinking was pertinent for long-term investing. Of course, at the time, the rest of the industry was dead against it (we will talk about this a bit later).

One thing we know for sure is that in almost every case, no matter how hard we try, market timing does not work or dare I say will not work. The only place I have seen it work is when, like in the movie Back to the Future, where knowing the scores of upcoming championship games, and using that information, one can make tons of money.

So why doesn’t market timing work? For one thing you must be right going in and coming out. There are just so many variables, so many moving parts, that there is absolutely no way we can comprehend, digest and act on them correctly all the time. In some cases, this must be done almost instantly. The academic literature is overwhelming on this and in fact quite emphatic about not doing it. And it is quite likely that the more we trade on urges the more mistakes we are likely to make.

Here is a good example of what I am talking about. If I had $1,000 invested in S&P 500 index in 1970, it would be worth $138,908 almost 50 years later in 2019. But if I had to succumb to trading and I was not in the market for the 15 best days over that period, I would only have $52,246. The difference between the two numbers is stark, much more than 50 percent loss. Nobody really knows which days are going to be the best or worst, and it behooves us to stay in the market over the ups and downs. Don’t let this roller coaster affect you much, keep your eyes on the goal.

This high uncertainty of our actions and its results was the reason why Bogle first proposed the index Fund. The evidence is overwhelming that active stock picking is not a very successful endeavor and it is extraordinarily difficult to start with. S&P publishes an annual report called SPIVA report which tracks active managers and has been doing it for over 25 years. Most active managers do not outperform their bogeys or goals; in fact, over a 10-year period 90 percent of them will be underperforming.

So, the obvious question is why doesn’t it work? Why can’t most of us get these predictions right? There are many reasons but two stand out in the minds of many people who are experts in that business.

First, we are predicting the future, and any predictions are always riddled with biases, guesses and misinformation, miscalculations. These biases infect peoples’ opinions and make it difficult to get accurate forecasts.

Second, we will never have complete information because things happen that are beyond our control and unpredictable (current geo-political situation including atmospheric calamities come to mind) and they influence and affect our predictions and hence outcome and actions. We are always looking for someone behind the curtain who knew everything about the future but there is no such person anywhere. Have you heard this old expression: “when the going gets rough, the tough start selling.”

The stock market will always go up and down, but it will always catch up and continue to advance; it is a matter of time. It is always better to ignore the short term and keep our eye on the distant horizon. The selection and judicious picking of the industries to invest in should be done with this idea in mind. There is no guarantee that even then we would succeed but we most certainly increase our chances many folds. Investments with a very distant horizon work the best because they absorb all the small and big pitfalls on the way. But picking the right vehicles to invest in is still a skill that needs to be learned and honed over time.

Mo Vidwans is an independent, board certified financial planner. For details visit, vidwansfinancial.com, call 734-476-0579 or write to: [email protected]