By Mo Vidwans

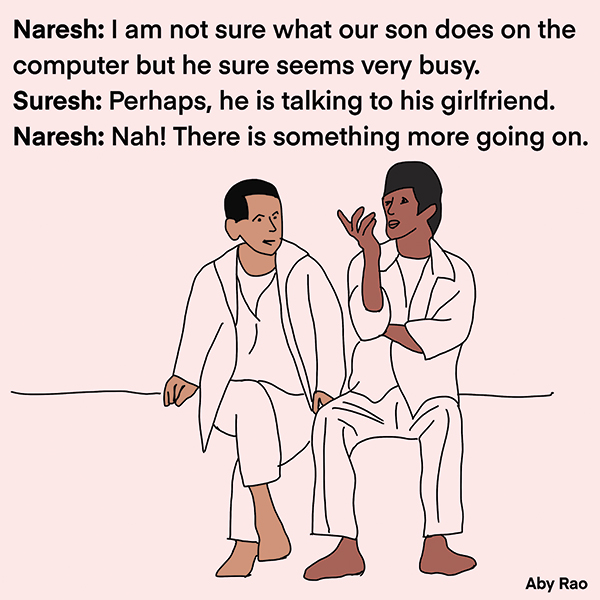

Those who are raising children, especially teenagers, know well how hard it is to know what is mulling in their minds. Teenagers can be moody, withdrawn and aloof and there is a communication impasse from both ends unless somehow those channels are kept open in absolute confidentiality. Then we try to gauge what interests they may have so that maybe we can expand on that and keep them engaged.

One thing is for sure, the old autocratic ways of doing things that perhaps we were subjected to, may not, do not work today. We are stressed as it is to get them to do their homework as such and other chores they are supposed to do. Are there any other activities where their real interest may lie?

Some go for different kinds of interests: video games for sure, repair of laptops and cell phones, art and many unusual sports come to mind as possible interests and also businesses, where even teenagers have been successful. Barron’s magazine in June 2021 had portrayed two teenagers, Ronak and Esha, who have successfully dabbled in stocks and are making money without spending a ton of time and without ignoring their studies.

Some go for different kinds of interests: video games for sure, repair of laptops and cell phones, art and many unusual sports come to mind as possible interests and also businesses, where even teenagers have been successful. Barron’s magazine in June 2021 had portrayed two teenagers, Ronak and Esha, who have successfully dabbled in stocks and are making money without spending a ton of time and without ignoring their studies.

JP Morgan, Fidelity and many others are making a deliberate attempt to tap this teenage market with the assumption that once you get them hooked and they see the benefit and perhaps the excitement in it, maybe they will stay with them for life.

There could be some truth in that; there is also some brand value in familiarity (GEICO and Liberty Mutual commercials come to mind).

I must admit the apps and the online platforms that exist today didn’t exist even a decade ago and it sure has made it so convenient for teens as well others to instantly buy/sell securities. There is also so much information available almost at the push of some keys, which is beneficial but could also become a problem.

Barron’s says, and I paraphrase, if there is an overarching challenge for teens and especially parents it’s finding a balance between righteous investing and the thrill of trading. The focus must be kept for learning and financial literacy, by making actual, real-life mistakes, albeit on a small scale, so that teenagers learn from experience but not get discouraged.

Many High Schools have started programs for seniors whereby allowing students to dip their tows in actual waters, by investing small amounts, they demystify the markets and teach a bit about its mechanics, too.

One of the reasons this is possible today and was rather difficult, if not impossible, in 80s and even 90s was that buying and selling securities was very expensive for individuals and the process was cumbersome and outright difficult. No broker paid much attention to a teenager unless he/she is completely backed by adults. Even today, I would venture say that without custodial oversight, it is basically a bad idea. In this regard my suggestion would be to get the teenager to discuss why he is thinking of buying/selling a particular stock with the adults, like responsible knowledgeable parents, and then execute. Right or wrong there must be a rationale behind all such actions and the teenagers have to know what they are. This is all part of learning.

At the age of 16 or 17 children could make decisions as well as adults but, on many occasions, they don’t have the backing of any previous experience. Adults, most of the times, go too much with their previous experience and are not willing to try new avenues. There are always exceptions. Teens tend to be more guided by their peers than adults. This makes a case for not only making sure that teens are in the right peer circle but also getting the peers to plant the right kind of bug for action in your teenager’s mind than parents doing it at home. For investments, maybe it is a good idea to get all the peers together and let them make a group decision. This is another lesson in consensus building, an indirect benefit.

There is no doubt, that an adult must be involved. Not only for opening an account but also for guiding the teenager through whatever decision-making processes they are applying. You would not wish them to buy just one stock like TIKTOK or GAMESTOP just because the stock happens to be hot. The question the teenager needs to tackle is will it be equally hot a month or a year from now and why?

Learning the long-term strategy is critical and teens need to learn that from adults who have emerged through the experience of hard knocks. Day-trading is not investing; it is not much different than a child playing with toys, and I would not suggest that for teens. Besides, I haven’t heard of anyone making any kind of money by day trading, most of them don’t.

If we consider the adult working life for these teens, their focus has to be on investing for long-term which has a totally different perspective than instant gratification. By long-term I am thinking more like a horizon of 30/40 years for them, if not longer. Such thinking is beneficial for them in their working lives, too. Granted there is a need for instant gratitude or satisfaction, but those things are at best fleeting and don’t linger too long.

As I have mentioned in earlier articles, let us start with opening a bank account and see it grow. Then slowly build up to opening a broker account and dabble in one stock maybe after enough research. One big advantage that may come out of this joint effort is bonding between two generations like father/mother and son/daughter.

Mo Vidwans is an independent, board certified financial planner. For details visit, VidwansFinancial.com, call 984-888-0355 or write to [email protected].