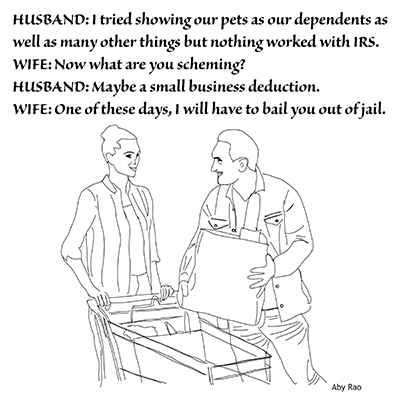

Now that a new year has arrived and the holidays and the festivities are behind us, kids are off to school again or will be shortly, our thoughts should be slowly turning to getting ready for the new tax season, particularly getting the paperwork ready and thinking of what deductions, exemptions and dependents we can take/claim etc. You may even have a preliminary tax return already done so that it will give you some idea what refund you should expect.

Tax preparation can be a bit scary at times and the thought that goes through many filers is will I get audited; what are the odds?

Most people can breathe easy. The vast majority of individual returns escape the IRS audit machine. In 2017, the latest data that is available, the individual audit rate was 0.6 percent which converts to one out of every 167 returns filed. More than 77 percent of these were handled by mail, meaning that taxpayer never had to meet an IRS agent in person. They just have a question or two about the way you may have put your numbers together for W2s or one of the 1099s or medical expenses and if a satisfactory answer is given by mail then that is the end of that. You don’t hear from the IRS again.

But there are red flags that the IRS consistently looks for.

As mentioned above, although the audit rate is low, your chances at the unenviable audit lottery go up depending on various factors such as 1) the complexity of your return 2) the types and amounts of deductions or other tax breaks you claim and 3) whether you happened to still be engaged in a business. Many folks from Asia have a side business going and occasionally their better judgment gets clouded by the thoughts of not declaring everything on the tax returns to save some taxes. Also, higher income tax payers have a greater audit risk.

A vast majority of the income statements we receive are covered by W2s and various kinds of 1099s and other documents. Be assured of the fact that a copy of the same goes to the IRS. Its computer crosschecks all such forms with whatever you have claimed on your return and if there is a mismatch the computer will spit out a notice that will be mailed to you. These notices are not counted as part of the audit accounted in the 0.6 percent number mentioned above. Hence, failing to report any taxable income from any wages, dividends, interests, pensions, IRA distributions, SSA benefits and other sources (for which you may not have the usual documents mentioned above) will almost certainly draw unwanted attention from the IRS. Be sure to report all income, even if you have not received paperwork such as 1099. For example, if you got paid for tutoring or as a personal trainer, may be for piano lessons, driving for Uber, selling crafts through Etsy or otherwise, making prom dresses (the list is endless), all that income is taxable.

Another big flag is claiming big deductions or other tax breaks – such as larger than normal charitable deductions or medical expenses. Now if your claims are legit and you have receipts for them and you can answer few questions when inquired, there is no problem, go ahead and take them. But if those write-offs are disproportionately large when compared with your income, your audit risk goes up because that is a factor in the IRS’s return selection process.

Taking a loss from investments or from the sale of rental property can also spike IRS’s curiosity.

If you are self employed or run a side business, Schedule C is a trove of tax deductions and consequently it is a gold mine for IRS agents. Business owners who have claimed a substantial loss on Schedule C or report at least $100,000 of gross receipts have a higher audit risk. Distinction between a hobby and a legit small business can get murky sometimes but not in the mind of IRS.

Handling an Audit

As mentioned before, if it is a simple letter inquiry from IRS and you give a satisfactory answer then the matter ends there. If they are more serious about what they are asking and matters proceed to the point of you having to go into IRS office to see the agent then it is a different story. Maybe you can handle it yourself without getting panicky but if not, consider hiring professional help. It is always recommended that you have a lawyer, CPA or other tax professionals represent you before the IRS. This way the personal attachments, emotions, fear or stress are eliminated when the actual meeting happens. Find a practitioner who is experienced and familiar with the ins and outs of the audit procedures. It is like plumbing in your house, you want a professional to handle it if your floors are flooded. The choice to bring in a professional depends on issues involved, complexity of the items and the dollar amount at stake among others.

Make sure though that you are prepared. Gather all the supporting documents. You can ask for extra time if you need it. Provide copies of the documents and not the originals and have a reasonable explanation for any discrepancies.

One thing is for sure: it is always better to try to do it right the first time. The error of admission is preferred to the error of omission.

———

Mo Vidwans is an independent, board-certified financial planner. For details visit www.vidwansfinancial.com, call +1 (984) 888-0355 or write to [email protected].